A staggering 75% of B2B sales engagements in 2025 will originate from signal-based triggers like leadership changes or funding rounds, according to Lantern Research’s latest forecast. This isn’t just another sales prediction – it’s a fundamental shift reshaping how successful teams approach prospect targeting. The days of random cold calling are rapidly fading as forward-thinking sales organizations embrace the power of trigger events. Companies utilizing these most important B2B sales trigger events see conversion rates jump by 400% compared to generic outreach approaches.

While many sales teams still rely on intuition and arbitrary timing, top performers are now systematically monitoring specific company signals that indicate buying readiness. By identifying these critical moments when organizations become receptive to new solutions, sellers can transform from interruptive annoyances into timely problem-solvers with exactly what the buyer needs.

Contents

Key Takeaways

- Leadership changes trigger vendor reviews with 68% higher likelihood within 90 days

- Companies securing Series B+ funding show 22% higher spending on operational tools within 6 months

- 78% of companies allocate new budgets at quarter or year beginnings, creating urgency

- 58% of acquired companies overhaul legacy systems within 12 months post-merger

- Sales teams monitoring trigger signals see 400% higher conversion rates versus generic outreach

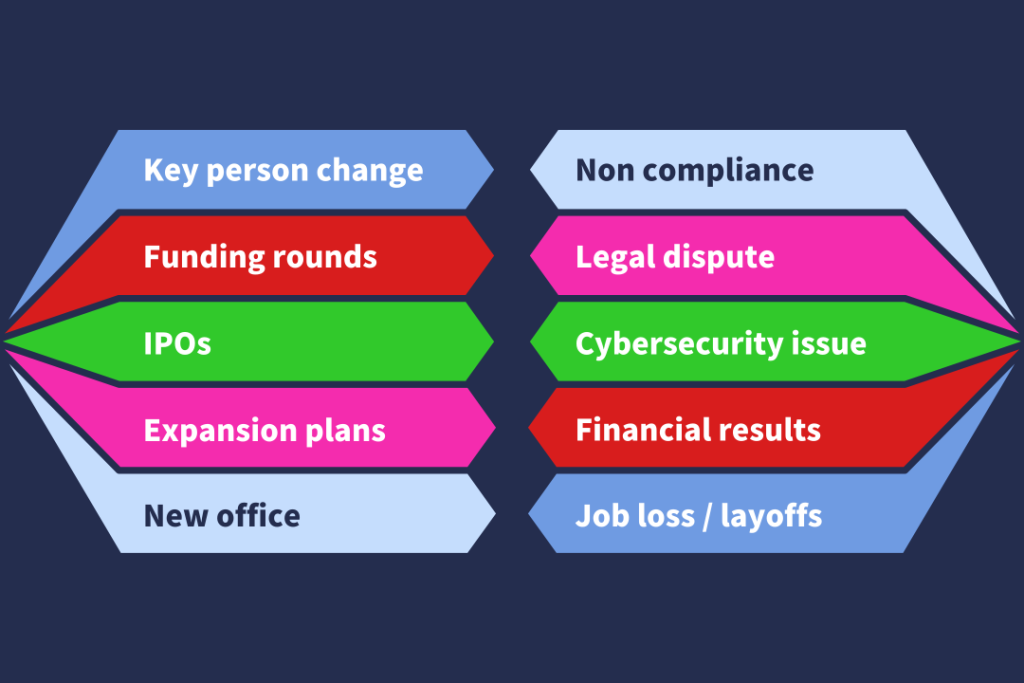

Leadership Changes: The Ultimate Buying Signal

When a new executive takes the helm, a critical window for sales opportunities opens. Recent data shows that new C-suite leaders are 68% more likely to review existing vendors within their first 90 days. This creates a prime opportunity to present solutions that align with their fresh vision and objectives.

Why Executive Transitions Matter

New leaders often arrive with mandates to drive change and improve performance. They’re typically less committed to legacy systems and more open to fresh approaches. The stark contrast in response rates tells the story: outreach tied to leadership changes achieves 14% response rates compared to just 1.2% for generic cold calls.

Top-performing organizations have recognized this pattern, which is why 63% of leading firms now systematically track executive movements using platforms like LinkedIn Sales Navigator. By leveraging buyer intent data, these companies can identify and act on these high-value signals before competitors.

How to Capitalize on Leadership Changes

The key to success lies in timing and relevance. When approaching newly appointed executives:

First, research their background and previous initiatives to understand their priorities. Next, customize your messaging to address how your solution helps them achieve early wins. Finally, act quickly – the first 30-60 days of a new appointment provide the highest engagement opportunity.

Financial Triggers: Following the Money

Money moves signal buying opportunities, especially in the form of new funding rounds and budget cycles. These financial events create immediate purchasing power and urgency that savvy sales professionals can leverage.

Funding Rounds and Investment Signals

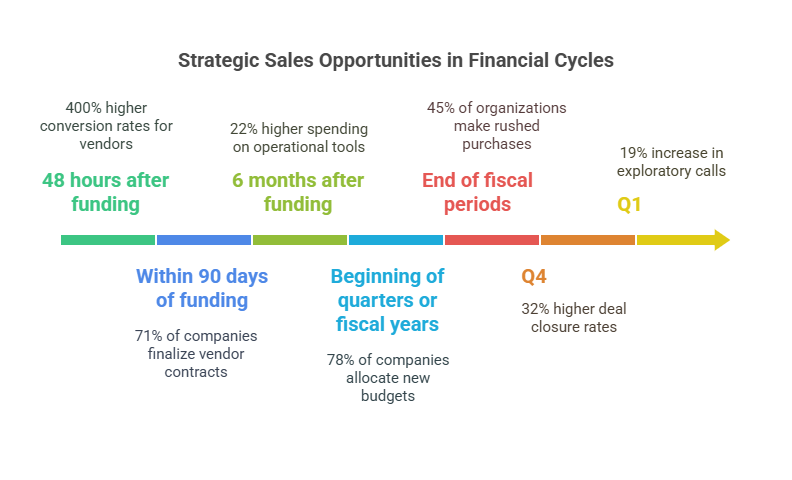

When a company secures significant funding, particularly Series B or later rounds, they enter a critical growth phase. Companies with fresh capital show 22% higher spending on operational tools within just six months of securing funding. The urgency to deploy this capital creates a unique opportunity for vendors who act quickly.

Harvard and Berkeley researchers discovered that 71% of funded companies finalize vendor contracts within 90 days when approached early. This speed advantage translates directly to results: vendors contacting funded firms within 48 hours experience 400% higher conversion rates compared to those who delay.

Budget Cycles and Fiscal Planning

Corporate budget cycles create predictable buying windows that smart sales teams leverage. A significant 78% of companies allocate new budgets at the beginning of quarters or fiscal years, creating time-sensitive opportunities.

The end of fiscal periods also drives purchasing behavior, with 45% of organizations making rushed purchases to utilize remaining funds. This pattern is particularly visible in certain industries – cybersecurity vendors, for example, report generating 55% of their annual revenue in November-December due to budget deadlines.

Quarter-to-quarter patterns reveal additional insights: Q4 typically shows 32% higher deal closure rates, while Q1 sees a 19% increase in exploratory calls as new budgets become available.

Organizational Change Triggers: Restructuring and Growth

Major organizational changes like mergers, acquisitions, or significant expansion create immediate needs for new technology and services. These transitions disrupt existing processes and create opportunities for solutions that facilitate integration or support growth.

Mergers and Acquisitions

Post-merger integration periods present exceptional sales opportunities. Data shows that 58% of acquired companies overhaul legacy systems within 12 months of the transaction, driving average deal sizes of $2.3 million for integration platforms.

The impact varies by product category, with HR SaaS tools seeing a 42% uptake post-merger due to workforce harmonization needs. Sales teams targeting these opportunities see dramatically better results, with M&A-focused outreach achieving 27% response rates compared to just 6% for standard campaigns.

Hiring Surges and Team Expansion

Companies in growth mode need tools and systems that scale with their expanding teams. Organizations increasing headcount by 15% or more year-over-year demonstrate 34% higher SaaS adoption rates to support their operations.

The correlation between team growth and technology purchases is particularly strong in technical departments. Engineering team expansions link to an 89% likelihood of DevOps tool purchases within six months. This pattern creates predictable opportunities for vendors who can spot buyer intent signals early.

CRM providers have capitalized on this trend, achieving 22% connect rates when targeting HR directors during documented hiring booms – nearly triple their baseline performance.

Geographic Expansion

When companies enter new markets or regions, they face immediate needs for localized tools and compliance solutions. Data shows companies opening offices in new territories require localized compliance tools (37% adoption rate) and specialized payroll systems (29% uptake).

Regional patterns emerge as well – companies entering Latin American markets drive 44% higher demand for multi-currency payment gateways within just three months of announcing their expansion.

Compliance and Technology Triggers

External factors like regulatory changes and technology obsolescence create buying urgency that transcends normal purchasing cycles. These forces compel organizations to act quickly, often with less price sensitivity than other purchase decisions.

Regulatory Compliance Deadlines

Regulatory changes create non-negotiable deadlines that drive purchasing decisions. In healthcare, 92% of providers prioritize purchases aligned with HIPAA updates, creating $4.1 billion in urgent spend annually.

The impact on sales cycles is dramatic – fintech companies typically experience 94-day sales cycles during normal periods, but this collapses to just 28 days following major regulatory announcements like GDPR-type legislation.

The key to capitalizing on these opportunities lies in educational content that helps buyers understand compliance requirements and positions your solution as the clearest path to meeting them.

Technology Obsolescence and End-of-Life

When technology platforms announce end-of-support dates, they create forced upgrade cycles that savvy vendors can leverage. A striking 81% of enterprises replace legacy systems after critical security audits, with cloud migration deals averaging $1.8 million.

Microsoft’s 2024 announcement about terminating Windows 10 support drove $620 million in PC-as-a-Service deals for managed service providers. This pattern repeats across the technology landscape, creating predictable buying windows.

SaaS providers have recognized this opportunity, reducing sales cycles by 30% through systematic monitoring of technology sunset announcements and platform deprecations.

Implementing an Effective Trigger Monitoring Program

Capitalizing on sales triggers requires systematic monitoring and quick response capabilities. Building these capabilities into your sales process can transform prospecting from a volume game to a precision operation.

Essential Tools for Trigger Monitoring

The foundation of successful trigger monitoring begins with the right technology stack:

LinkedIn Sales Navigator remains the industry standard, used by 63% of top-performing firms to track leadership changes and hiring patterns. AI-powered signal platforms are gaining traction, with Lantern’s 2025 research predicting autonomous agents will drive 40% of sales qualified leads via real-time trigger detection.

CRM integration proves critical for execution – HubSpot users experience 28% faster response times when linking trigger alerts directly to contact records for immediate action.

Response Protocols and Timing

The value of trigger signals degrades rapidly with time. Organizations capturing the most value implement 24-48 hour response protocols for high-value triggers like funding announcements or leadership changes.

Creating trigger-specific outreach templates with personalization focused on the relevant event significantly improves conversion rates. The best-performing teams build lead lists that connect trigger events to specific value propositions their solution delivers.

By establishing clear ownership and accountability for trigger response, sales teams can ensure no high-value signal goes without timely follow-up.

FAQ

What are the most responsive B2B sales triggers?

Leadership changes generate the highest response rates (14% vs. 1.2% for cold calls), followed by funding rounds (71% of funded companies finalize vendors within 90 days) and mergers/acquisitions (58% of acquired companies overhaul systems within 12 months). Budget cycles and regulatory changes also drive significant purchasing activity.

How quickly should sales teams respond to trigger events?

For maximum effectiveness, respond within 24-48 hours of high-value triggers like funding announcements or executive appointments. First-mover vendors contacting funded firms within 48 hours see 400% higher conversion rates. The effectiveness of trigger-based outreach declines substantially after the first week.

What tools are best for monitoring sales triggers?

LinkedIn Sales Navigator (used by 63% of top firms) excels for tracking leadership changes. Other effective options include specialized trigger platforms with CRM integrations (HubSpot users see 28% faster response times), Crunchbase for funding alerts, and industry-specific news monitoring services for regulatory and compliance changes.

How can I measure the ROI of trigger-based selling?

Compare response rates, conversion rates, and sales cycle length between trigger-based outreach and standard prospecting. Top teams track metrics like time-to-contact after trigger identification and deal sizes from trigger-sourced opportunities. Many find trigger-based approaches yield 4x higher conversions and 30% shorter sales cycles.

Sources

- UserGems – 18 Most Common Buying Triggers for B2B Sales & Marketing

- UserGems – The 23 Most Important Sales Trigger Events for B2B Sales

- Cleverviral – B2B Sales Triggers: Everything You Need to Know for 2024

- Lantern – The B2B SaaS Sales Intelligence Index: Lantern’s Prediction Report 2025

- eGrabber – How B2B Sales Triggers Help You Exceed Sales Quotas

- Fundz – Ultimate Guide Sales Trigger Events

- Goodmeetings – Identifying Triggers & Buying Signals

- HubSpot – B2B Telemarketing