German companies experiencing 29% higher growth with fractional CMOs while cutting costs by 74% reveals a fundamental truth about performance measurement in Europe’s largest economy. I’ve spent the past decade working with German executives who demand precision in every metric, and their approach to evaluating fractional CMO performance differs significantly from other markets.

This post delivers the exact KPIs and measurement frameworks that resonate with German CEOs, showing you how to build dashboards and reporting systems that align with their engineering-driven decision-making culture.

Contents

- 1 TL;DR

- 2 The German CEO Mindset: Engineering Precision in Marketing Measurement

- 3 Essential Financial KPIs: The Foundation of German Executive Trust

- 4 Revenue-Focused Performance Indicators

- 5 Digital Marketing Excellence in Germany’s €30,9 Billion Market

- 6 Technology Integration: AI-Powered Efficiency Metrics

- 7 ROI Calculation Frameworks: Structured Approaches for German CEOs

- 8 Implementation Strategy: Building Dashboards for German Executive Teams

- 9 FAQ

- 9.1 What are the most important KPIs German CEOs expect from fractional CMOs?

- 9.2 How do German business culture and expectations differ for marketing metrics?

- 9.3 What ROI should fractional CMOs demonstrate to German executives?

- 9.4 Which digital marketing metrics matter most in Germany’s €30,9 billion market?

- 10 Sources

TL;DR

German CEOs prioritize specific fractional CMO KPIs that demonstrate measurable business impact and operational efficiency. The disconnect between marketing and executive measurement approaches creates opportunities for fractional CMOs who understand German business culture’s emphasis on precision, long-term strategic planning, and consensus-building decision processes.

- 70% of CEOs measure marketing based on year-over-year revenue growth versus only 35% of CMOs

- German companies expect 5:1 ROMI as good performance and 10:1 as exceptional

- Digital marketing spending reaches €30,9 billion in 2024 with 10% projected growth

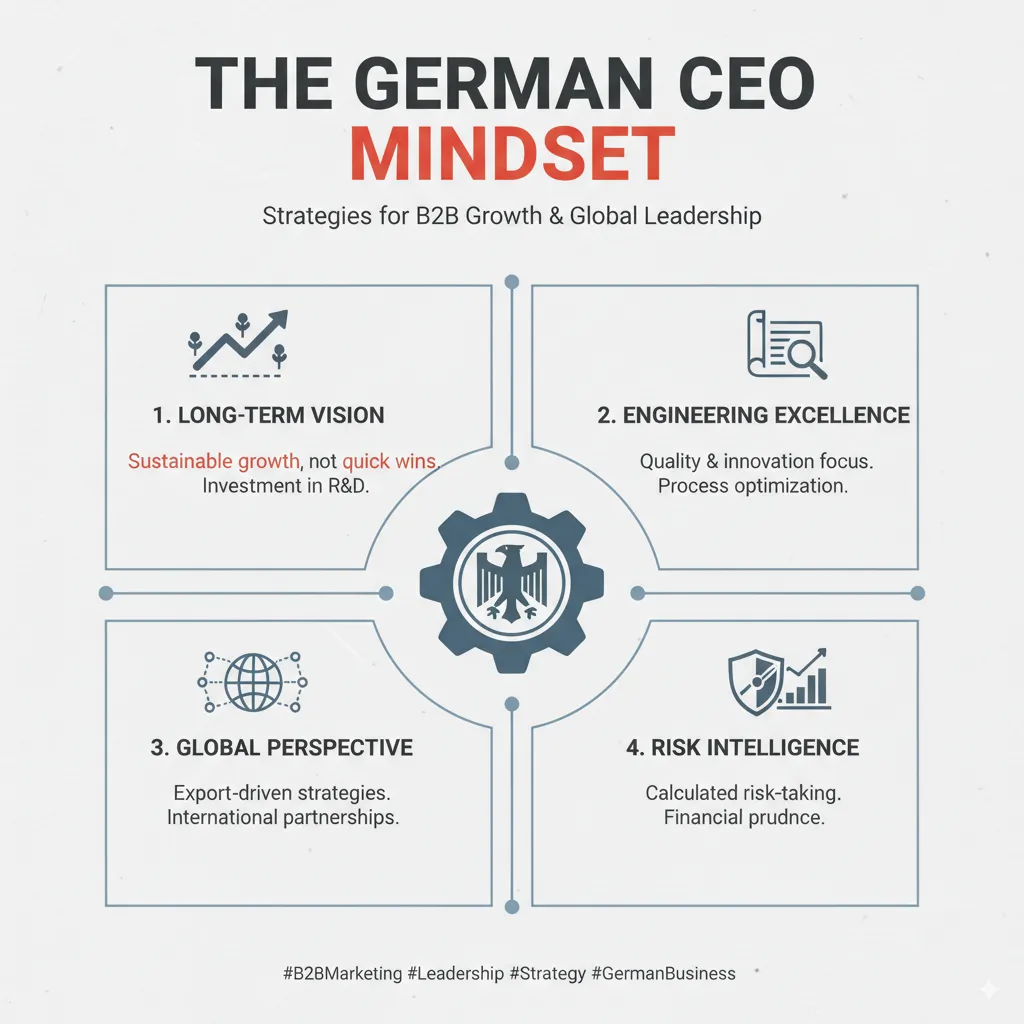

The German CEO Mindset: Engineering Precision in Marketing Measurement

The German approach to marketing measurement reflects decades of engineering excellence applied to business operations. I’ve observed firsthand how German executives evaluate marketing performance through a lens of systematic precision and long-term value creation. The emphasis on structured decision-making and consensus-building creates distinct expectations that fractional CMOs must understand to succeed.

Performance reviews in German companies incorporate detailed metrics that create accountability at every level. This culture demands that fractional CMOs demonstrate measurable impact through data-driven approaches aligned with organizational goals. The stark disconnect where 70% of CEOs measure marketing based on year-over-year revenue growth while only 35% of CMOs track this metric highlights a critical alignment opportunity.

Cultural Factors Shaping KPI Expectations

German business culture prioritizes Budgetmanagement (budget management) with exceptional rigor, yet organizational maturity in this area often falls short of expectations. This gap creates significant opportunities for fractional CMOs who can introduce sophisticated financial tracking systems. The preference for quarterly planning cycles with detailed monthly reviews reflects the structured approach German companies take toward performance evaluation.

The consensus-building nature of German decision-making means that KPIs must serve multiple stakeholders simultaneously. Marketing metrics need to satisfy not just the CEO but also CFOs, operations leaders, and board members who all participate in strategic decisions. This multi-stakeholder environment demands comprehensive yet clear measurement frameworks.

Long-term Strategic Focus Over Short-term Wins

German executives consistently prioritize sustainable growth metrics over vanity metrics or short-term campaign successes. This perspective shapes how fractional CMOs should structure their reporting and measurement systems. Revenue predictability and customer retention rates carry more weight than viral campaign metrics or social media follower counts.

The emphasis on operational efficiency means that process improvement metrics gain particular importance. German CEOs want to see how marketing investments improve overall business operations, not just generate leads. This holistic view requires fractional CMOs to connect marketing activities to broader organizational objectives through integrated KPI frameworks.

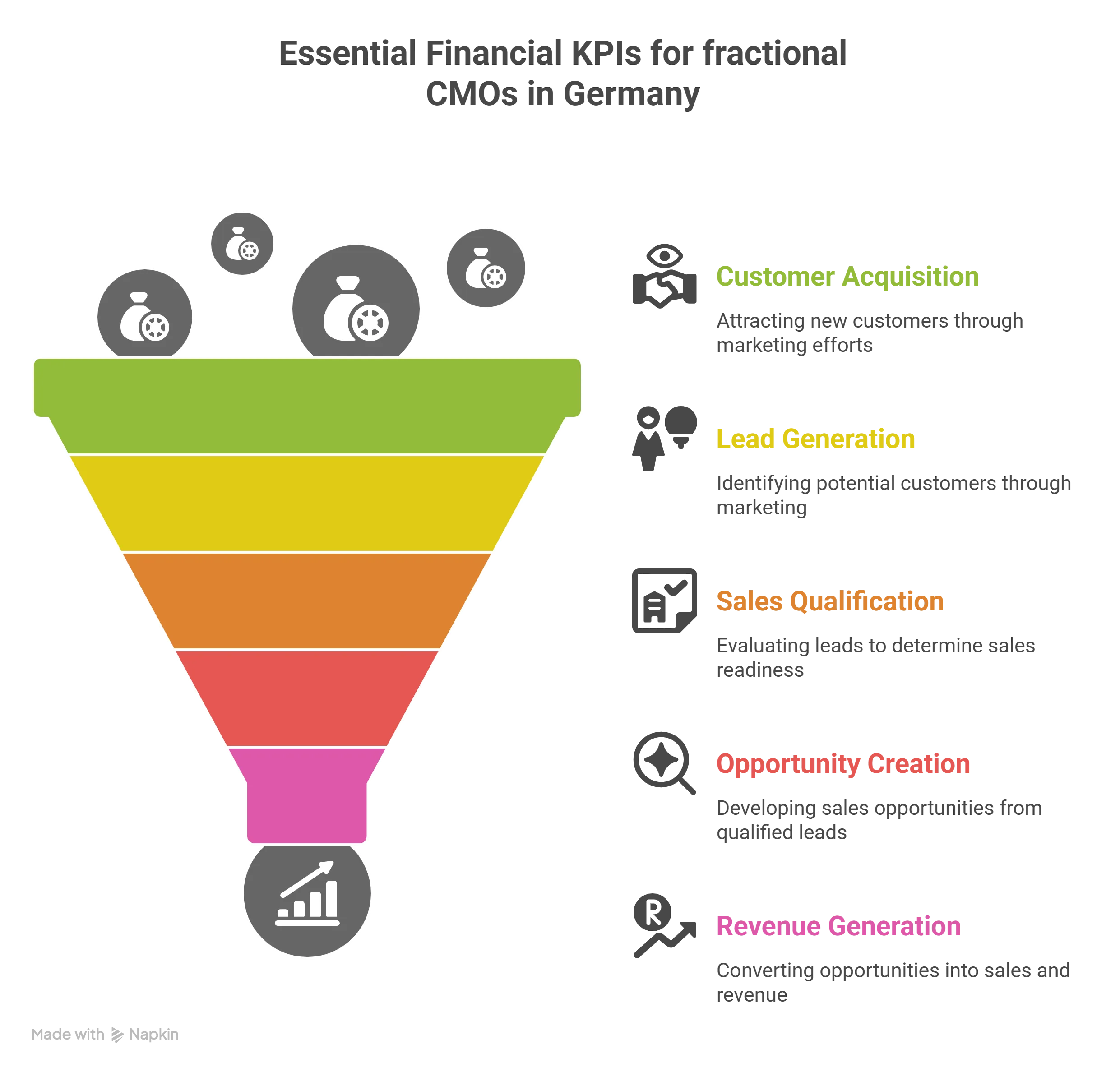

Essential Financial KPIs: The Foundation of German Executive Trust

Financial metrics form the cornerstone of how German CEOs evaluate fractional CMO performance. The calculation precision required reflects the engineering mindset prevalent in German business culture. These metrics must demonstrate clear cause-and-effect relationships between marketing investments and business outcomes.

Customer Acquisition Cost and Lifetime Value Dynamics

Customer Acquisition Cost (CAC) calculation involves dividing total marketing and sales costs by new customers acquired within specific timeframes. German companies demand granular breakdowns of these costs, including direct advertising spend, personnel time allocation, and technology infrastructure investments. The precision extends to calculating CAC by channel, campaign, and even individual customer segments.

Customer Lifetime Value (CLV) provides the essential counterbalance to acquisition costs. German businesses particularly value the CLV to CAC ratio because it demonstrates sustainable growth potential. A healthy ratio of 3:1 or higher satisfies German executive expectations, while ratios below 2:1 trigger immediate scrutiny and demands for optimization strategies.

The interplay between these metrics becomes especially critical when presenting to German boards. I’ve found that visualizing the CLV:CAC ratio evolution over time, broken down by customer cohorts, provides the analytical depth German executives expect while maintaining clarity for strategic decision-making.

Return on Marketing Investment Standards

Return on Marketing Investment (ROMI) calculations follow the formula: (Returns – Marketing Investment) / Investment. German companies typically expect 5:1 ratios as good performance and 10:1 as exceptional, with anything below 2:1 considered unprofitable. This expectation exceeds global averages and reflects the German market’s emphasis on efficiency.

The ROMI calculation methodology must account for both direct and indirect returns. German executives appreciate when fractional CMOs include attribution modeling that tracks multi-touch customer journeys. This comprehensive approach aligns with the German preference for thorough analysis over simplified metrics.

Marketing Qualified Leads (MQLs) measurement takes on particular significance in German B2B contexts. Rather than focusing on volume, German companies prioritize lead quality scoring that considers multiple engagement factors. The MQL to SQL (Sales Qualified Lead) conversion rate becomes a critical efficiency indicator that demonstrates marketing’s contribution to revenue generation.

Revenue-Focused Performance Indicators

Revenue growth stands as the ultimate measure of marketing success for German CEOs, with 54% prioritizing this as their top business expectation from marketing leadership. This laser focus on financial outcomes requires fractional CMOs to establish clear connections between marketing activities and revenue generation.

Pipeline Contribution and Sales Alignment

Pipeline contribution tracking measures marketing’s direct impact on qualified opportunities progressing through sales stages. German companies value this metric because it demonstrates tangible business value rather than abstract lead volumes. The measurement requires sophisticated CRM integration to track lead sources, engagement touchpoints, and conversion progression.

I’ve implemented pipeline contribution models for German manufacturing clients that track opportunity value from initial marketing touch through closed deals. This approach satisfies the German preference for complete visibility into cause-and-effect relationships. The ability to attribute specific revenue amounts to marketing campaigns provides the accountability German CEOs demand.

Sales growth attribution specifically isolates marketing’s contribution to overall revenue increases. Given that only 37% of marketing campaigns met performance expectations in 2023, this metric provides essential accountability. German executives particularly appreciate when fractional CMOs can demonstrate incremental revenue generated above baseline growth rates.

Conversion Rate Optimization Across the Funnel

Conversion rate tracking at each funnel stage enables systematic optimization aligned with German engineering principles. The metrics span from initial website visits through MQL generation, SQL acceptance, opportunity creation, and final purchase decisions. This granular tracking identifies specific bottlenecks requiring optimization.

German B2B companies typically see conversion rates varying significantly by industry and sales cycle length. Benchmark establishment becomes critical for setting realistic expectations and demonstrating improvement over time. The ability to show consistent conversion rate improvements, even by small percentages, resonates with German executives who value continuous optimization.

The focus extends beyond simple conversion metrics to include velocity indicators. German CEOs want to understand how quickly prospects move through the funnel and where acceleration opportunities exist. This temporal dimension adds sophistication to the measurement framework while providing actionable insights for process improvement.

Digital Marketing Excellence in Germany’s €30,9 Billion Market

Digital advertising spending in Germany reached €30,9 billion in 2024, with 10% growth projected for 2025. This massive investment demands sophisticated performance tracking across multiple channels. German CEOs expect fractional CMOs to maximize returns from this digital transformation while maintaining cost efficiency.

Multi-Channel Attribution and Mobile Optimization

The disconnect between user behavior and advertising spend creates measurable optimization opportunities. With 66% of online shoppers using mobile devices for purchases yet advertisers continuing desktop focus, fractional CMOs can demonstrate value through mobile-first strategies. The metrics must track mobile conversion rates, app engagement, and cross-device attribution.

Website traffic analysis gains critical importance with 90% of Germans online. Source attribution must account for complex customer journeys spanning search engines, social platforms, email, and direct traffic. German executives expect sophisticated attribution models that assign appropriate credit to each touchpoint rather than simplistic last-click attribution.

Search engine advertising, digital banner campaigns, and video advertising each require channel-specific KPIs. German companies value metrics that show not just impressions and clicks but actual business outcomes from each channel. The ability to demonstrate incremental value from each advertising euro spent becomes essential for budget justification.

Social Media and Email Marketing Performance

Social media engagement measurement gains importance as 50,8% of users between 16 and 64 research brands on social platforms. WhatsApp, Instagram, and Facebook dominate the German social landscape, requiring platform-specific metrics that go beyond follower counts. Engagement quality, sentiment analysis, and conversion attribution from social sources provide meaningful insights.

Email marketing maintains exceptional relevance in Germany’s high-engagement market. German consumers expect personalized, relevant communications, making segmentation effectiveness a critical metric. Open rates, click-through rates, and email-attributed revenue must be tracked with precision to demonstrate channel value.

Retail media performance measurement becomes increasingly critical with 24% growth expected in this segment. The emergence of retailer-owned advertising platforms requires new measurement approaches that account for closed-loop attribution and incremental sales lift. German retailers particularly value metrics showing how advertising drives both online and offline purchases.

Technology Integration: AI-Powered Efficiency Metrics

Technical expertise has become a differentiating factor, with 67% of German companies explicitly expecting knowledge of CRM, video analytics, and HTML skills from marketing leadership. This technical requirement extends to understanding and implementing AI-powered marketing solutions that drive measurable efficiency gains.

Content Creation and Personalization Effectiveness

AI integration demonstrates measurable impact through content creation efficiency metrics. Successful implementations show 30% reduction in content creation time and 25% increase in customer engagement. These improvements appeal directly to German CEOs who value operational excellence and productivity optimization.

Personalization effectiveness measurement tracks how AI-driven campaigns impact customer behavior and conversion rates. German companies implementing sophisticated segmentation report significant success, with personalization serving as a key growth driver. The metrics must include relevance scores, engagement lift, and revenue impact from personalized experiences.

I’ve worked with German automotive suppliers who achieved 15% response rate improvements through AI-powered personalization. The key was establishing clear baseline metrics before implementation, then tracking incremental improvements across customer segments. This methodical approach satisfies German executive expectations for rigorous performance measurement.

Marketing Automation and GenAI Performance

Marketing automation performance tracking measures campaign efficiency improvements and workload reductions. German businesses value metrics showing both cost savings and performance gains from automation investments. Time savings per campaign, error rate reductions, and speed-to-market improvements all factor into the evaluation.

GenAI implementation success requires specific KPIs including content generation speed, quality scores, and conversion impact. Case studies showing 5% conversion rate improvements through GenAI integration provide benchmarks for German companies evaluating these investments. The ability to demonstrate ROI from AI investments becomes critical for continued funding.

The combination of Marketing Mix Modeling (MMM) with Multi-Touch Attribution (MTA) provides the sophisticated tracking German companies expect. This dual approach enables high-level strategic planning while maintaining granular campaign optimization capabilities. German executives appreciate the balance between strategic insights and tactical optimization this combination provides.

ROI Calculation Frameworks: Structured Approaches for German CEOs

Fractional CMO ROI calculation requires systematic approaches that German CEOs can easily evaluate and verify. The basic formula: ROI = (Net Benefits – Cost of CMO) / Cost of CMO × 100 provides the foundation, but German executives expect more sophisticated analysis including risk factors and scenario planning.

Cost Comparison and Value Demonstration

The average full-time CMO costs between $200.000 and $350.000 annually, while fractional CMOs cost $3.000 to $15.000 monthly. This cost differential creates compelling value propositions when combined with performance metrics. German CEOs particularly appreciate when fractional CMOs can demonstrate equivalent or superior results at fractional costs.

Time frame determination becomes critical for accurate measurement. German companies typically prefer quarterly assessments with monthly progress tracking, aligning with their structured planning cycles. This cadence enables continuous value demonstration while allowing strategic adjustments based on performance data.

Intangible benefits measurement addresses knowledge transfer, methodology introduction, and network access value. While German companies prioritize quantifiable metrics, they recognize these qualitative improvements’ importance. Systematic approaches like stakeholder surveys and process improvement documentation help quantify these traditionally intangible benefits.

Attribution Modeling and Performance Benchmarking

Attribution modeling requires sophisticated approaches tracking marketing impact across touchpoints. German companies benefit from combining Marketing Mix Modeling for strategic planning with Multi-Touch Attribution for tactical optimization. This comprehensive approach satisfies the German preference for thorough analysis while maintaining actionable insights.

Performance benchmarking against industry standards provides essential context. Comparing results to the 2,5:1 average marketing ROI and 5:1 good performance benchmarks helps establish realistic expectations. German CEOs appreciate when fractional CMOs provide competitive benchmarks showing how their performance compares to industry leaders.

The ROI calculation must account for both short-term gains and long-term value creation. German executives value sustainable growth over quick wins, so ROI frameworks should include metrics like customer retention improvements, brand value increases, and market share gains alongside immediate revenue impact.

Implementation Strategy: Building Dashboards for German Executive Teams

Marketing dashboard creation becomes essential for German CEOs who demand real-time visibility into performance metrics. The dashboard design must balance comprehensive data presentation with clarity, avoiding information overload while providing sufficient detail for informed decision-making.

Dashboard Architecture and KPI Selection

Effective dashboards integrate CAC, CLV, MQL flow, and channel performance costs into unified views. German companies particularly value dashboards showing progress against quarterly sprints with weekly increment tracking. This structure aligns with agile methodologies while maintaining the strategic oversight German executives require.

KPI selection should focus on meaningful metrics directly supporting business objectives. The tendency to track everything must be resisted in favor of curated metrics that drive decisions. German CEOs appreciate when dashboards clearly show causal relationships between marketing activities and business outcomes.

Cross-departmental integration ensures marketing metrics align with overall business performance indicators. Shared KPIs across departments foster collective ownership and collaboration toward common goals. This approach addresses the German cultural preference for consensus-building and structured decision-making processes.

Review Cycles and Continuous Improvement

Regular review cycles should follow German business practices with formal quarterly assessments and monthly progress reviews. This structure enables fractional CMOs to demonstrate continuous value delivery while maintaining strategic flexibility. The reviews should include variance analysis, explaining deviations from targets and proposing corrective actions.

Performance improvement tracking becomes critical for maintaining executive confidence. German CEOs expect to see trend lines showing consistent optimization across key metrics. Even small incremental improvements, when sustained over time, demonstrate the systematic approach German businesses value.

The implementation strategy must include change management considerations. German organizations often resist rapid changes, preferring evolutionary improvements over revolutionary transformations. Fractional CMOs should plan phased implementations that allow teams to adapt while maintaining operational continuity.

FAQ

What are the most important KPIs German CEOs expect from fractional CMOs?

German CEOs prioritize revenue growth attribution, Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and Return on Marketing Investment (ROMI) as primary KPIs. They expect a CLV:CAC ratio of at least 3:1 and ROMI of 5:1 or higher. These metrics must be presented within structured quarterly reporting cycles that show clear connections between marketing investments and business outcomes, aligned with German preferences for precision and accountability.

How do German business culture and expectations differ for marketing metrics?

German business culture emphasizes engineering precision, long-term strategic planning, and consensus-building in decision-making. This creates expectations for detailed, accurate metrics with clear cause-and-effect relationships. German CEOs prefer comprehensive quarterly assessments over real-time dashboards alone, value sustainable growth metrics over vanity metrics, and require cross-departmental KPI alignment to support collaborative decision-making processes.

What ROI should fractional CMOs demonstrate to German executives?

Fractional CMOs should demonstrate minimum ROI of 200% (2:1), with 500% (5:1) considered good performance and 1000% (10:1) as exceptional in German markets. The calculation must include both tangible returns like revenue growth and cost savings, plus intangible benefits such as knowledge transfer and process improvements. German executives expect quarterly ROI assessments with detailed attribution modeling showing how marketing investments drive specific business outcomes.

Which digital marketing metrics matter most in Germany’s €30,9 billion market?

In Germany’s substantial digital market, CEOs focus on multi-channel attribution, mobile optimization metrics, and platform-specific performance indicators. Key metrics include mobile conversion rates (critical given 66% mobile shopping adoption), email marketing ROI (Germany has exceptional engagement rates), and social media conversion tracking across WhatsApp, Instagram, and Facebook. Retail media performance measurement becomes increasingly important with 24% expected growth in this segment.