In today’s hyper-competitive marketplace, a shocking 67% of B2B companies waste their marketing budget targeting prospects who will never convert. This costly misalignment stems from a fundamental gap: the absence of a well-defined ideal customer profile. Companies that create ideal customer profiles with precision are reporting dramatic results – 45% higher conversion rates and 30% lower customer acquisition costs compared to their competitors operating on gut instinct alone.

The data doesn’t lie: when businesses implement a structured ideal customer profile framework based on actual customer behavior rather than assumptions, their sales cycles shorten by an average of 18 days. Beyond efficiency gains, ICP-aligned organizations demonstrate remarkable pipeline quality improvements, with prospects moving through sales stages 2.4x faster.

For forward-thinking businesses in 2025, building an ideal customer profile template isn’t just another marketing exercise – it’s the fundamental blueprint that aligns your entire go-to-market strategy with the customers who genuinely need your solution.

Contents

Key Takeaways

- Companies using advanced ICP strategies achieve 45% higher conversion rates and 30% lower acquisition costs than competitors

- Modern ICPs combine firmographic data with psychographic drivers like pain point hierarchies and behavioral triggers

- Data-driven ICP development requires both quantitative analysis (CRM mining) and qualitative validation (buyer interviews)

- Successful ICPs need regular refinement through quarterly audits examining six key dimensions

- Technology tools can substantially improve ICP execution by automating prospect identification and integration with marketing systems

Understanding Core ICP Components

Building an effective ideal customer profile starts with recognizing its essential components. Unlike basic marketing personas, a comprehensive ICP forms the bedrock of targeted business growth by combining multiple data dimensions into a cohesive targeting framework.

Firmographic Foundations

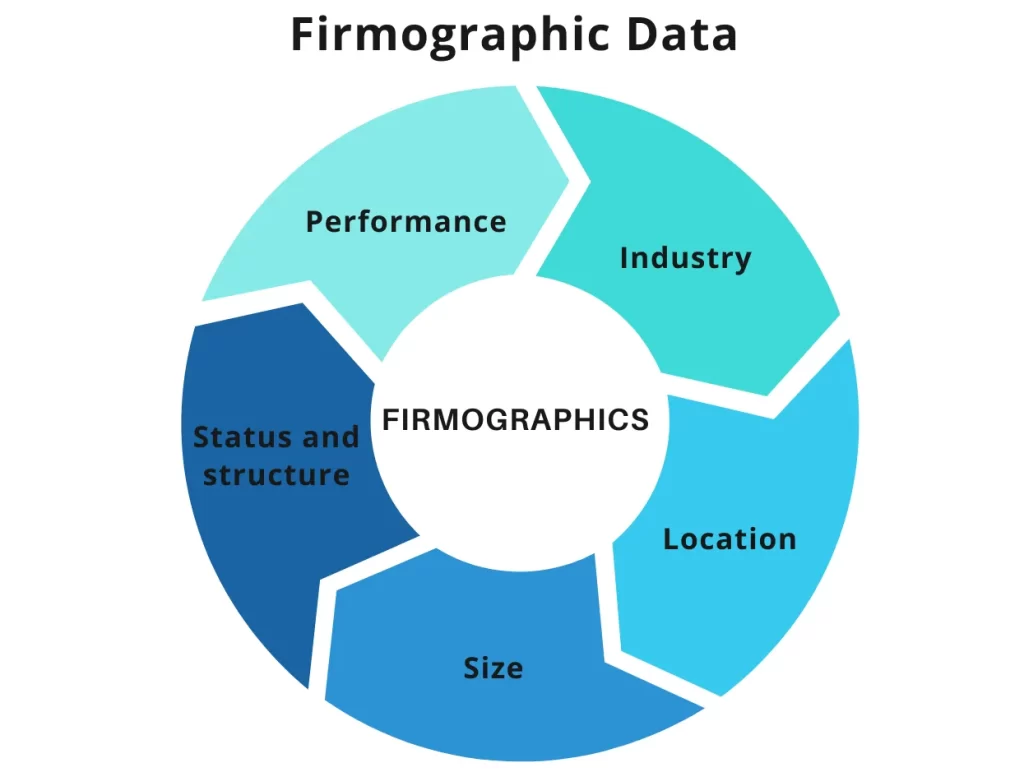

Firmographic elements provide the structural backbone of your ICP. The 2025 standard requires much more specific parameters than previous approaches:

Revenue metrics now demand precise bracketing – such as distinguishing between startups with $1M ARR versus enterprise clients generating $50M+. Company size classifications have similarly evolved beyond simple headcount to examine department-specific staffing patterns that indicate buying potential.

Tech infrastructure has become a critical indicator of fit, with 78% of successful ICPs tracking specific software integrations like Salesforce CRM implementation or AWS cloud infrastructure. This technographic layer helps identify prospects whose existing systems align with your solution’s capabilities.

Operational characteristics matter tremendously too. Companies with complex approval chains need different sales approaches than those with lean decision-making structures. Identifying these patterns helps you discover genuine pain points that differentiate high-potential customers from poor-fit prospects.

Psychographic Drivers

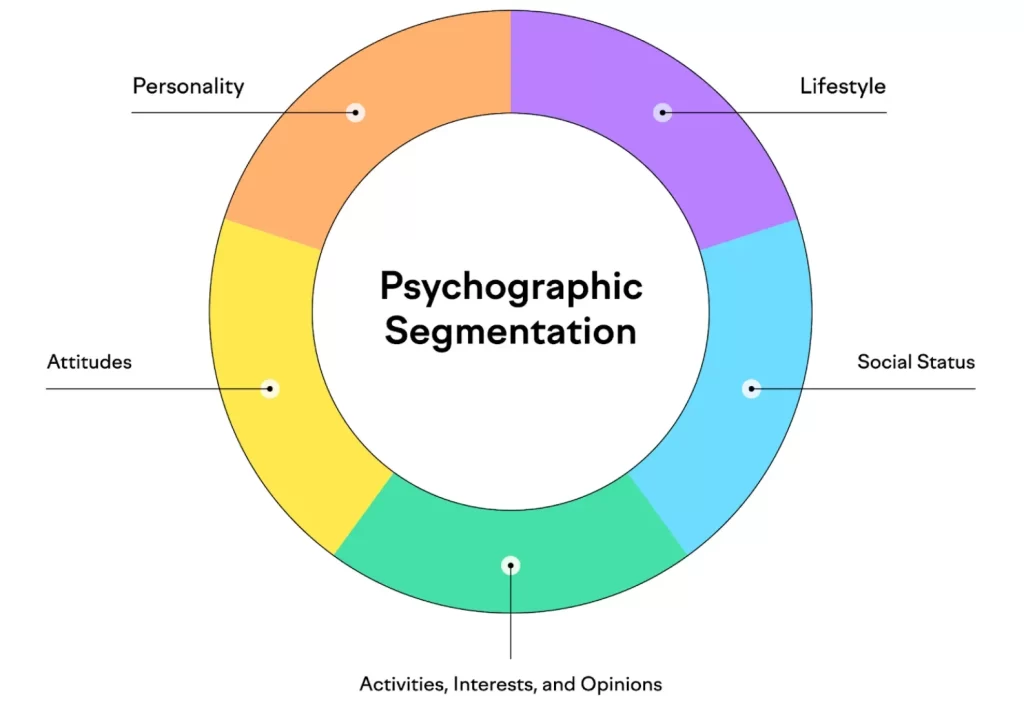

While firmographics tell you who might buy, psychographic elements reveal why they buy. Modern ICPs dig deeper into motivation:

Pain point hierarchies organize challenges by priority – for instance, 62% of tech buyers rank “lead scoring accuracy” as their primary concern above other issues. Mapping these hierarchies helps craft messaging that resonates with what truly matters to decision-makers.

Value alignment has gained significance, with 82% of enterprises now requiring ESG compatibility in vendor relationships. Understanding a prospect’s organizational values creates stronger connections beyond mere functional benefits.

Behavioral triggers document specific actions that indicate buying readiness. For example, research shows 73% of B2B decision-makers engage with webinar content before making purchase decisions. Tracking these digital footprints allows for more precise timing of sales outreach.

Data-Driven ICP Development Process

Creating an ideal customer profile isn’t guesswork – it requires methodical data collection and analysis from multiple sources. The most effective ICPs combine quantitative insights with qualitative validation.

Quantitative Analysis Phase

Start with systematic mining of your CRM data to identify patterns among your most successful customers:

Deal velocity metrics reveal valuable insights – accounts with sales cycles under 60 days often represent high-priority ICP candidates. Similarly, customers demonstrating 120%+ net revenue retention typically indicate excellent product-market fit that can be replicated.

Technographic profiling tools like ZELIQ help analyze technology adoption patterns that correlate with success. For instance, 58% of ideal customers tend to operate hybrid cloud infrastructure rather than pure on-premises or cloud-only environments.

This data-first approach establishes objective parameters that move beyond anecdotal sales experiences to identify genuine patterns across your customer base. The quantitative foundation helps create an ideal customer profile template that sales and marketing teams can consistently apply.

Qualitative Validation Stage

Numbers tell only part of the story. To develop a complete understanding, you need direct conversations with key stakeholders:

Buying committee interviews should target both economic buyers (like CFOs who approve purchases exceeding $100k) and technical evaluators (such as CTOs assessing integration feasibility). These structured conversations reveal decision criteria that may not appear in your CRM data.

Win/loss analysis adds another critical dimension by categorizing recent deal outcomes. For example, 58% of lost deals cite missing API capabilities as a primary reason – information that helps refine your ICP to focus on prospects whose technical needs align with your current offerings.

These qualitative insights help validate your data-driven assumptions and perfect your message-market fit by revealing subtle factors that influence buying decisions beyond what appears in analytics reports.

Leveraging Technology for ICP Implementation

Modern ICP development relies heavily on specialized tools that automate data collection and analysis processes. The right technology stack dramatically improves both accuracy and efficiency.

Automation Platforms

Purpose-built ICP platforms offer powerful capabilities that manual methods can’t match:

ZELIQ ProspectIQ filters over 250 million B2B records using 23 distinct ICP dimensions. This includes real-time funding alerts that identify Series B+ companies and technology adoption scores that reveal prospects with compatible tech stacks.

Machine learning tools like Breadcrumbs Reveal detect hidden patterns in your conversion data that humans might miss. These platforms achieve up to 89% accuracy in predictive lead scoring by analyzing combinations of firmographic and behavioral signals.

These technologies enable even smaller marketing teams to build sophisticated ICPs by automating the heavy computational work of pattern recognition across vast datasets. This lets you focus on strategic interpretation rather than manual data gathering.

Integration Requirements

Your ICP becomes truly operational when it’s seamlessly connected to your existing tech stack:

CRM synchronization means mapping Salesforce fields to ICP parameters like opportunity source (distinguishing partner referrals from cold outreach) and support ticket frequency (ideal customers typically average fewer than two monthly tickets).

Marketing technology alignment requires configuring platforms like HubSpot to trigger ICP-specific content sequences. For instance, technical buyers receive in-depth whitepapers while financial stakeholders get ROI calculators aligned with their specific concerns.

These integrations ensure your ICP becomes an active driver of daily operations rather than a static document. When properly connected, your systems can automatically route leads based on ICP fit and personalize engagement based on profile attributes.

Creating Comprehensive ICP Documentation

An ideal customer profile must be formalized into accessible documentation that guides all customer-facing teams. This documentation takes various forms depending on organizational needs.

Template Components

A complete ICP template includes multiple sections addressing different aspects of customer fit:

The firmographic section captures basic company details (industry, size, revenue, location) but adds critical context like growth trajectory and organizational maturity. These details help sales teams qualify prospects before deeper engagement.

Technographic profiles document required tech stack components, integration points, and IT infrastructure preferences. This technical layer helps product teams prioritize development while enabling sales to address compatibility concerns proactively.

Decision-maker persona sections map the roles, responsibilities, goals, and challenges of key stakeholders involved in purchase decisions. This information supports tailored communications addressing each individual’s specific priorities within the buying committee.

The buying process documentation outlines typical sales cycles, approval chains, and budget authority structures. Understanding these procedural elements helps build lead lists that match your sales motion.

Visualization Methods

Effective ICPs translate complex data into accessible formats that drive action:

Scoring matrices provide quantitative frameworks for evaluating how closely prospects match your ideal profile. These tools typically use weighted attributes that calculate an overall fit percentage, helping prioritize outreach efforts.

Customer journey maps visualize how ideal customers progress through awareness, consideration, and decision stages. These timelines highlight critical touchpoints and decision factors at each phase, guiding content creation and sales interventions.

Value proposition alignment charts connect specific customer pain points to corresponding product capabilities. These visual tools help sales teams quickly customize their pitch to address what matters most to each prospect based on their ICP attributes.

Continuous ICP Optimization

An ideal customer profile is never truly finished. Market conditions, competitor offerings, and your own product capabilities evolve constantly, requiring regular ICP refinement.

Performance Monitoring

Ongoing measurement ensures your ICP remains accurately targeted:

Conversion metrics specific to your ICP provide the clearest indicators of effectiveness. Mature ICPs typically achieve lead-to-opportunity conversion rates around 35%, with consistent deal sizes showing minimal variance (under 15% deviation) across similar customers.

Financial impact calculations provide the business justification for ICP investment. For SaaS companies, customer acquisition cost recovery periods under 9 months and LTV:CAC ratios exceeding 3.5x indicate a well-optimized ICP driving profitable growth.

These metrics help quantify the return on your ICP investment while highlighting areas needing refinement. Regular dashboard reviews keep stakeholders aligned on progress and adjustment priorities.

Iteration Cadence

Structured reviews maintain ICP relevance over time:

Quarterly ICP audits should systematically examine six key dimensions: demographic shifts in target industries, emerging technographic requirements, pricing model compatibility, support complexity metrics, competitive positioning updates, and economic sensitivity thresholds.

A/B testing frameworks provide empirical validation for ICP refinements. By comparing control groups (using existing ICP criteria) against variant groups (testing new parameters), you can measure the impact of potential changes before full implementation.

This disciplined approach to optimization prevents ICP drift while incorporating new market insights. Each iteration should be documented with version control to track evolution and provide continuity across team changes.

FAQ

What’s the difference between an ideal customer profile and a buyer persona?

An ideal customer profile focuses on company-level characteristics identifying organizations most likely to benefit from your solution. Buyer personas complement ICPs by detailing individual stakeholder roles within those organizations. Use your ICP to target the right companies, then leverage personas to personalize communication with specific decision-makers.

How often should I update my ideal customer profile?

Conduct comprehensive ICP reviews quarterly, examining six dimensions: demographic shifts, technographic requirements, pricing compatibility, support metrics, competitive positioning, and economic sensitivity. More significant updates typically occur during major product launches, market expansions, or strategic pivots that fundamentally change your target audience.

What metrics indicate my ICP needs refinement?

Watch for rising customer acquisition costs, lengthening sales cycles, declining conversion rates, and increasing churn among recently acquired customers. When average deal sizes show high variance (exceeding 15%) or your LTV:CAC ratio drops below 3.5x, your ICP likely needs adjustment to better align with genuinely good-fit prospects.

Can smaller companies with limited data create effective ICPs?

Yes. Start with your best current customers, supplemented by competitive intelligence and industry research. Tools like ZELIQ and Breadcrumbs offer smaller companies access to vast data pools that compensate for limited internal data. Focus initially on firmographic basics and pain points, then enrich your profile as you gather more customer information through direct interactions.

Sources

- ZELIQ Blog – How To Build Your ICP With ZELIQ: Step-by-Step Guide

- HG Insights – How To Create An Ideal Customer Profile (ICP)

- UserMotion – How To Identify Ideal Customer Profile (ICP)

- Breadcrumbs – How To Create An Ideal Customer Profile

- Zendesk – Create Data-Rich Customer Profile

- Cognitive Market Research – ICP-AES Market Report

- Omnius – How To Create ICP For SaaS

- TrainingSites – 10 General Purpose Marketing Task Prompts