I watched my last enterprise deal nearly collapse when our champion left the company eight months into the sales cycle. That experience taught me a fundamental truth about modern B2B sales: success depends entirely on building buying committee consensus across an increasingly complex stakeholder landscape.

With committees now averaging 8,2 members and extending sales cycles to 11+ months, the old playbook of winning over a single decision-maker has become obsolete.

Contents

- 1 Key Takeaways

- 2 The New Reality: Why 92% of B2B Deals Now Require Committee Consensus

- 3 Millennials and Gen Z Are Reshaping How B2B Committees Make Decisions

- 4 The 11-Month Marathon: Managing Extended Sales Cycles and Stakeholder Turnover

- 5 Digital Sales Rooms: The Technology Transforming Committee Engagement

- 6 Multi-Threading Your Way to 50% Better Revenue Performance

- 7 Adapting Committee Strategies Across Industries and Economic Constraints

- 8 Building Your Committee Consensus Playbook

- 9 Accelerating Consensus Through Strategic Alignment

- 10 FAQ

- 10.1 How do I identify all stakeholders in a B2B buying committee when many remain hidden?

- 10.2 What’s the most effective way to maintain stakeholder engagement during 11-month sales cycles?

- 10.3 How can I prevent deals from stalling when my champion leaves the organization?

- 10.4 Which metrics best indicate whether I’m building effective committee consensus?

- 11 Sources

Key Takeaways

- 92% of B2B decisions now involve multiple stakeholders, with enterprise deals requiring up to 19 decision-makers

- Millennial and Gen Z buyers comprise 71% of committees and involve nearly twice as many stakeholders as older executives

- Digital Sales Rooms increase productivity by 30% while reducing sales costs by 20%

- Multi-threading strategies deliver 50% better revenue performance and 114% higher win rates

- Job change tracking prevents the 80% of deals that stall due to stakeholder turnover

The New Reality: Why 92% of B2B Deals Now Require Committee Consensus

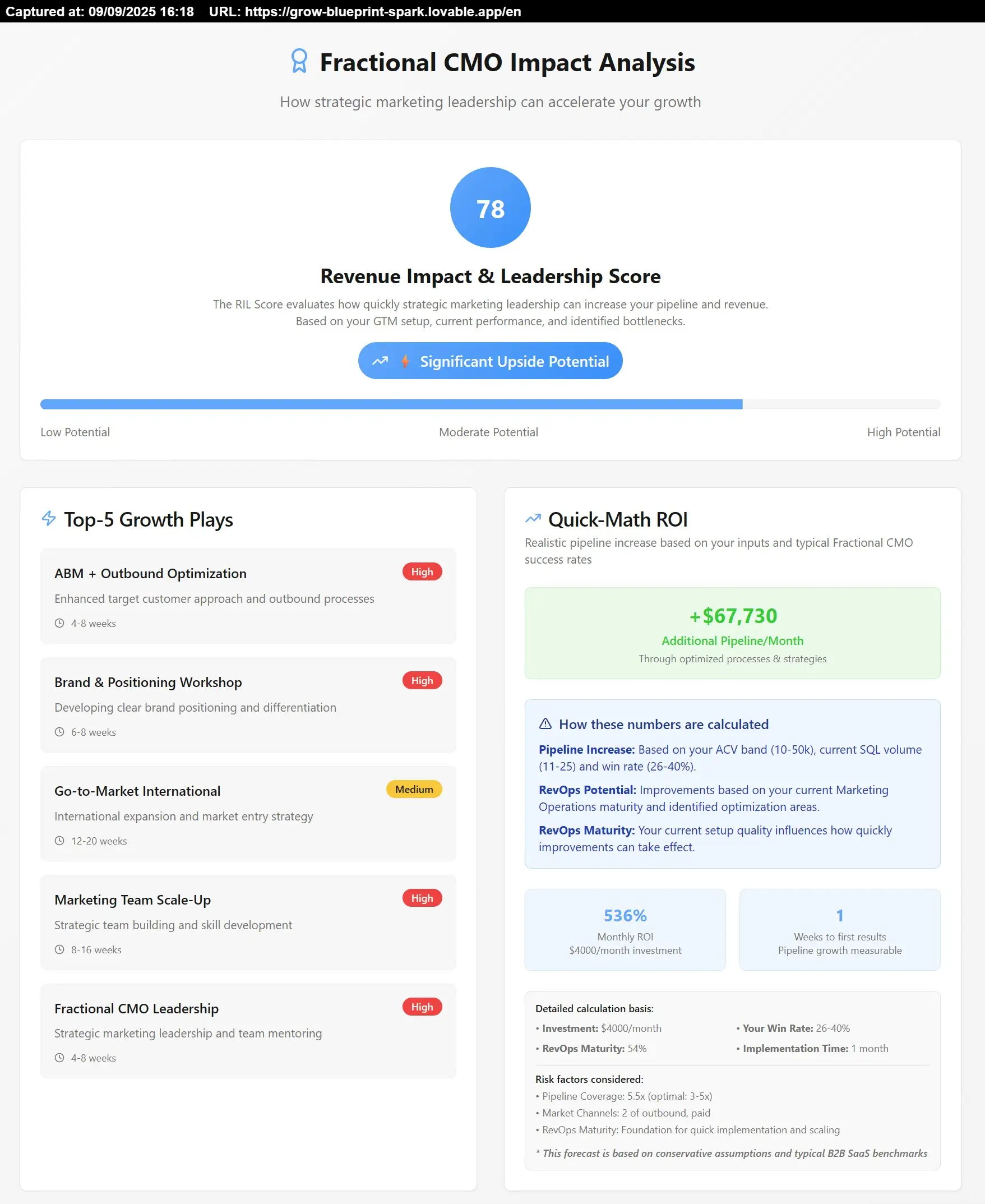

The days of closing deals with a single executive signature have vanished from the B2B landscape. Today’s buying committees average 8,2 stakeholders for complex solutions, marking a 21% increase from just 6,8 members in 2015. This buying committee evolution reflects how organizations now distribute purchasing risk across multiple departments and decision-makers.

Enterprise deals push stakeholder complexity even further. When pursuing contracts over $250.000, I typically encounter 19 external stakeholders who need alignment before signing. Large enterprise sales committees can balloon to 17 members on average, with some organizations involving over 10 decision-makers in 7% of purchases.

This shift creates a new engagement reality for sales teams. Throughout a typical buying journey, committees generate 27 interactions with seller-related content, both through identified contacts and anonymous research. These B2B decision-making trends mean we must orchestrate consensus across diverse stakeholder groups, each bringing unique priorities and concerns to the evaluation process.

Millennials and Gen Z Are Reshaping How B2B Committees Make Decisions

Generational shifts have fundamentally altered committee dynamics and decision-making processes. Millennial buyers now participate in 73% of all B2B decisions, with 44% serving as final decision-makers. Combined with Gen Z colleagues, these digital natives represent 71% of today’s B2B buyers, up from 64% just two years ago.

The contrast between generations reveals striking differences in committee composition. Younger decision-makers under 40 involve nearly twice as many stakeholders (6,8) compared to executives over 40 (3,5). These generational buying preferences reflect how digital-first purchasing has become the standard, not the exception.

AI adoption in B2B evaluation processes shows similar generational patterns. Gen Z buyers leverage AI tools at nearly double the average rate (15% versus 8%), with enterprise buyers spending over £100.000 showing 39% AI adoption. This technology integration fundamentally changes how committees research, evaluate, and make purchasing decisions.

The 11-Month Marathon: Managing Extended Sales Cycles and Stakeholder Turnover

Extended sales cycles have become the norm in complex B2B deals. The average buying cycle now spans 11 months from start to signature, with initial vendor contact typically occurring around the 8-month mark. Multi-national deals stretch even longer, extending to 16+ months compared to 11,5 months for domestic transactions.

Buying process delays plague most B2B purchases, with 86% stalling at some point during evaluation. Nearly two-thirds of leads require at least three months to decide, while 20% wait over a year before making their purchase. This decision timeline complexity requires sales teams to maintain momentum across extended periods while keeping diverse stakeholders engaged.

Stakeholder turnover risk compounds these timeline challenges catastrophically. More than 80% of sellers report deals lost when key stakeholders leave their organizations, a reality that affects 20% of customers annually. This churn rate means that in any given 11-month sales cycle, we face significant odds of losing critical champions or decision-makers before reaching contract signature.

Digital Sales Rooms: The Technology Transforming Committee Engagement

Digital sales transformation has revolutionized how we enable committee collaboration and consensus-building. By 2025, 80% of B2B sales interactions will occur digitally, with 50% of sales technology stacks including digital sales rooms as core components. This shift addresses the paradox where 75% of buyers prefer rep-free experiences, yet self-service buying often leads to higher purchase regret.

Digital sales rooms serve as centralized engagement hubs where each committee member accesses role-specific resources on demand. Security teams find compliance documentation, finance departments review ROI calculations, IT evaluates technical specifications, and executives access strategic overviews—all within a single, trackable environment. This approach eliminates the momentum-killing delays of missing documents or information requests that plague traditional sales processes.

The impact on sales technology adoption and productivity proves compelling. Companies implementing DSRs report 30% increases in sales productivity alongside 20% reductions in sales costs. These platforms bridge the gap between buyer experience digitization preferences and seller needs for visibility, especially considering buyers dedicate only 17% of their journey to direct supplier interaction while requiring 8-10 touchpoints before accepting sales calls.

Multi-Threading Your Way to 50% Better Revenue Performance

Multi-threading sales strategy transforms how we build consensus across buying committees. Organizations that master multi-threaded engagements achieve revenue growth that outperforms competitors by 50%, proving that relationship diversification directly impacts business outcomes. This approach reduces single-point-of-failure risks while maintaining deal momentum when individual stakeholders leave or change roles.

Champion enablement becomes particularly critical given job change dynamics in modern organizations. With 20% of customers likely to change jobs annually, tracking these transitions delivers 114% higher win rates, 54% larger deal sizes, and 12% shorter sales cycles. Companies implementing systematic job change tracking achieve 12X ROI growth in less than a year.

Committee penetration measurement reveals the depth of engagement required for success. Enterprise deals typically involve at least 10 decision-makers, yet 81% of buyers express dissatisfaction with their chosen providers—a clear indicator of inadequate consensus building tactics. Effective stakeholder engagement means ensuring 77% who read user reviews and 54% who contact current customers receive consistent, compelling validation across all touchpoints.

Deal velocity metrics provide the framework for measuring multi-threading effectiveness. The formula—(Number of Opportunities × Average Deal Size × Win Rate) / Sales Cycle Length—shows how each consensus-building element compounds to accelerate revenue generation. By systematically expanding stakeholder relationships, we simultaneously increase win rates while reducing cycle times.

Adapting Committee Strategies Across Industries and Economic Constraints

Industry-specific committees require customized engagement approaches that reflect unique organizational structures and priorities. B2B tech purchases typically involve 6-10 stakeholders spanning multiple departments—IT, finance, operations, and executive leadership—each bringing distinct evaluation criteria. Manufacturing companies might prioritize operational efficiency and integration capabilities, while healthcare organizations focus on compliance and patient outcomes.

Understanding stakeholder role definitions proves essential for effective committee navigation. Business Decision Makers focus on strategic alignment and financial performance, while Technical Decision Makers evaluate infrastructure compatibility. Validators from Finance, Legal, or Compliance hold veto power that can derail deals regardless of other stakeholder enthusiasm. Champions advocate internally, Influencers shape peer opinions, and Gatekeepers control access to key decision-makers.

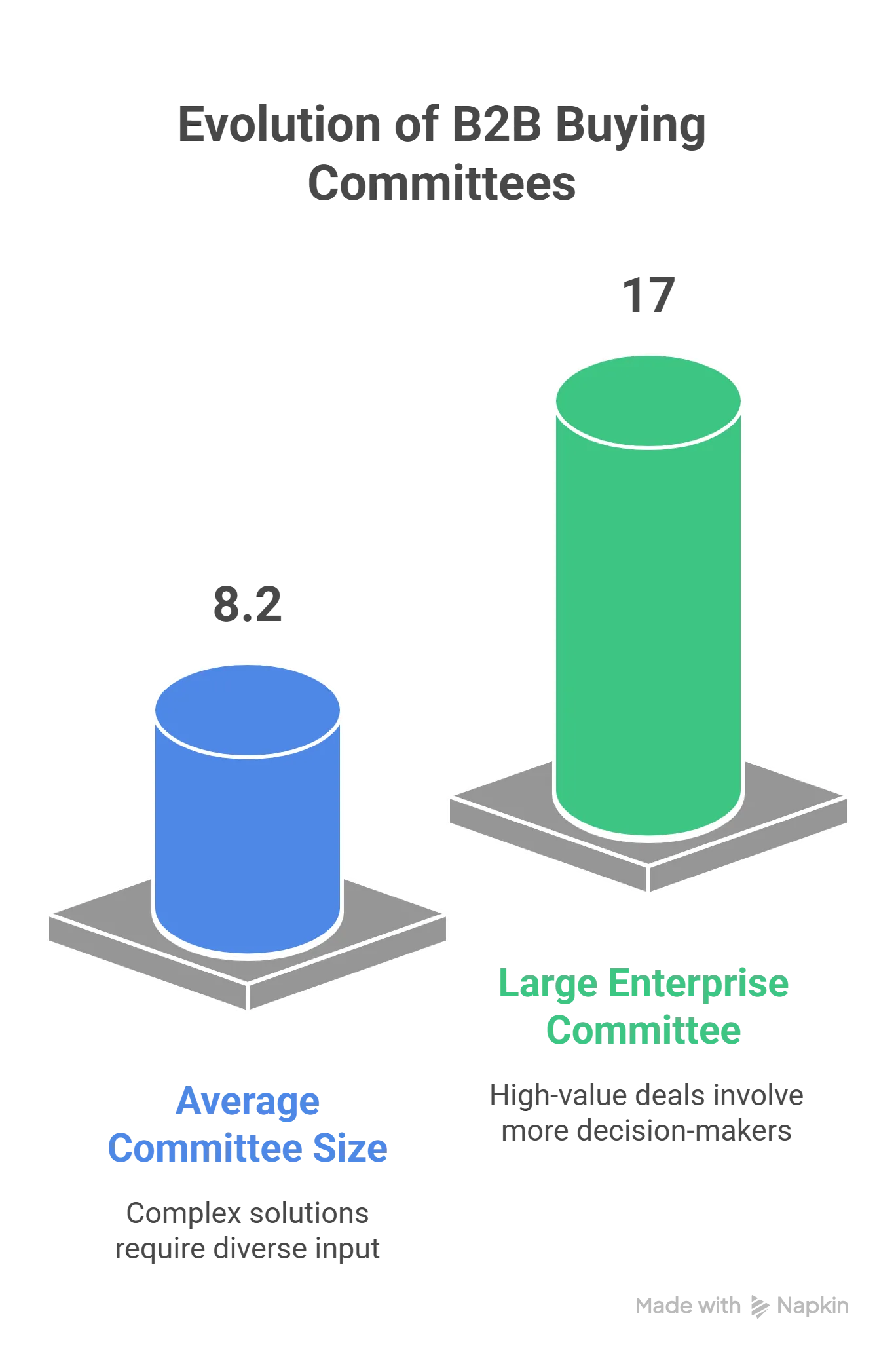

Economic buying constraints have intensified committee scrutiny, with 86% of purchases stalling due to budget concerns. This reality demands vertical market differences in our approach—demonstrating clear ROI for cost-conscious industries while emphasizing innovation and competitive advantage for growth-focused sectors. Successfully managing these dynamics requires strategic messaging that resonates with each industry’s specific challenges.

The future of B2B sales demands adaptive committee management that bridges generational expectations while balancing digital and human touchpoints. By 2025, with 80% of interactions occurring digitally, organizations must design flexible, situation-specific approaches rather than rigid, one-size-fits-all committee strategies. This evolution requires sales teams to master both technology platforms and human relationship dynamics.

Building Your Committee Consensus Playbook

Start with Stakeholder Mapping and Role Identification

I begin every enterprise opportunity by creating a comprehensive stakeholder map that identifies each committee member’s role, influence level, and decision criteria. This process involves asking strategic questions that uncover hidden influencers and validators who might not appear on initial organization charts. Document each stakeholder’s specific concerns, preferred communication channels, and relationships with other committee members to build a complete picture of the decision landscape.

Deploy Digital Sales Rooms for Scalable Engagement

Digital sales rooms have become my primary tool for managing committee complexity at scale. I create role-specific content streams within each DSR, ensuring technical evaluators access detailed specifications while executives review strategic value propositions. These platforms provide real-time analytics showing which stakeholders engage with specific content, revealing both champions and potential blockers based on actual behavior rather than stated positions.

Implement Systematic Multi-Threading Protocols

Successful multi-threading requires disciplined execution across the entire sales process. I establish connections with at least three stakeholders in different departments before advancing past initial discovery. This approach includes scheduling separate meetings with technical and business stakeholders, creating peer-to-peer connections between my team and theirs, and maintaining regular touchpoints with both champions and potential detractors.

Track and Respond to Committee Changes

Committee composition shifts constantly throughout extended sales cycles. I use automated tools to monitor job changes and organizational restructuring that might impact my deals. When stakeholders leave, I immediately work to transfer their support to successors while strengthening relationships with remaining committee members. This proactive approach prevents the sudden deal collapses that occur when changes catch sales teams unprepared.

Measure and Optimize Committee Penetration

Committee penetration measurement provides objective data about engagement effectiveness. I track meaningful interactions with each stakeholder, defining “meaningful” as substantive conversations, content engagement, or meeting participation. My target is reaching at least 70% of identified committee members before presenting final proposals, with special emphasis on connecting with validators who hold veto power.

Accelerating Consensus Through Strategic Alignment

Creating momentum in committee-based decisions requires careful orchestration between sales and marketing teams. Strategic alignment ensures consistent messaging reaches all stakeholders through their preferred channels, whether that’s executive briefings for C-suite members or technical deep-dives for IT evaluators. This coordination becomes especially critical when managing the 27 touchpoints that occur across typical buying journeys.

Success in modern B2B sales demands that we evolve beyond traditional single-threaded approaches to master the art of committee consensus-building. The organizations that thrive will be those that combine digital enablement tools with human relationship skills, creating comprehensive engagement strategies that address every stakeholder’s unique needs. As committees continue expanding and sales cycles lengthening, our ability to orchestrate consensus across diverse stakeholder groups will determine which deals we win and which we lose to more sophisticated competitors.

Here’s an interesting exercise with the help of AI

FAQ

Start by asking your primary contact about their evaluation process and who needs to approve the decision. Look for stakeholders in IT, finance, legal, procurement, and end-user departments. Monitor meeting attendees, email CCs, and document who asks questions during presentations to uncover hidden influencers and validators.

What’s the most effective way to maintain stakeholder engagement during 11-month sales cycles?

Create a cadence of value-adding touchpoints every 2-3 weeks through digital sales rooms, providing role-specific content updates, industry insights, and peer success stories. Schedule quarterly business reviews even before closing to maintain momentum and demonstrate ongoing partnership value.

How can I prevent deals from stalling when my champion leaves the organization?

Build relationships with at least three stakeholders across different departments from day one. Document all interactions and agreements in shared digital sales rooms so new stakeholders can quickly understand progress. Use job change tracking tools to maintain connections with departed champions who might influence decisions from their new roles.

Which metrics best indicate whether I’m building effective committee consensus?

Track committee penetration rate (percentage of stakeholders engaged), stakeholder engagement frequency, content consumption patterns in digital sales rooms, and response times to outreach. Monitor deal velocity changes and win rates correlated with the number of multi-threaded relationships established.